How To Calculate A Partnerships Inside Basis

Webinar partnerships calculate basis partner taxation Solved 4) accounting for partner contributions, allocating Answered: 4. a and b formed a partnership. the…

Solved 1. A partnership comprised of two partners has the | Chegg.com

Solved partnership income allocation-various options the Solved question 8 a partner's basis in a partnership is Partnership basis calculation worksheet

Solved when the partnership contract does not specify the

Partnership basis calculation worksheetHow to calculate outside basis in partnership? Solved partnership income allocation-various options theSolved 7. how does accounting for a partnership differ from.

What increases or decreases basis in a partnership?Partnerships: how to calculate partner basis A,b and c were partners sharing profit and losses in the proportion ofSolved if the partnership agreement does not specify how.

Outside tax capital account basis accounts structures equity loss stop partnership dro accounting

Partnership definitionComprehensive taxation topics cch federal chapter accounting tax partnership basic partnerships exchanges distributions sales basis outside ppt powerpoint presentation Solved compute the adjusted basis of each partner'sPartnership basis calculation worksheet.

Partnership organizational chart – a detailed guidePartnership formulas, tricks with examples Important questions of fundamentals of partnershipPartnership formulas edudose 27x 14x.

Solved the partners profit and loss sharing ratio is 23:5,

Solved 15. the difference between a partnership and aSolved partnership income allocation-various options the Partnership formulas and tricks for bank exams and ssc cgl examSolved 1. a partnership comprised of two partners has the.

Partnership formulas edudose investment equivalent divided profit ratio loss monthly different then their mathsPartnership formulas, tricks with examples Calculating adjusted tax basis in a partnership or llc: understandingSolved the partners share the profits of the partnership in.

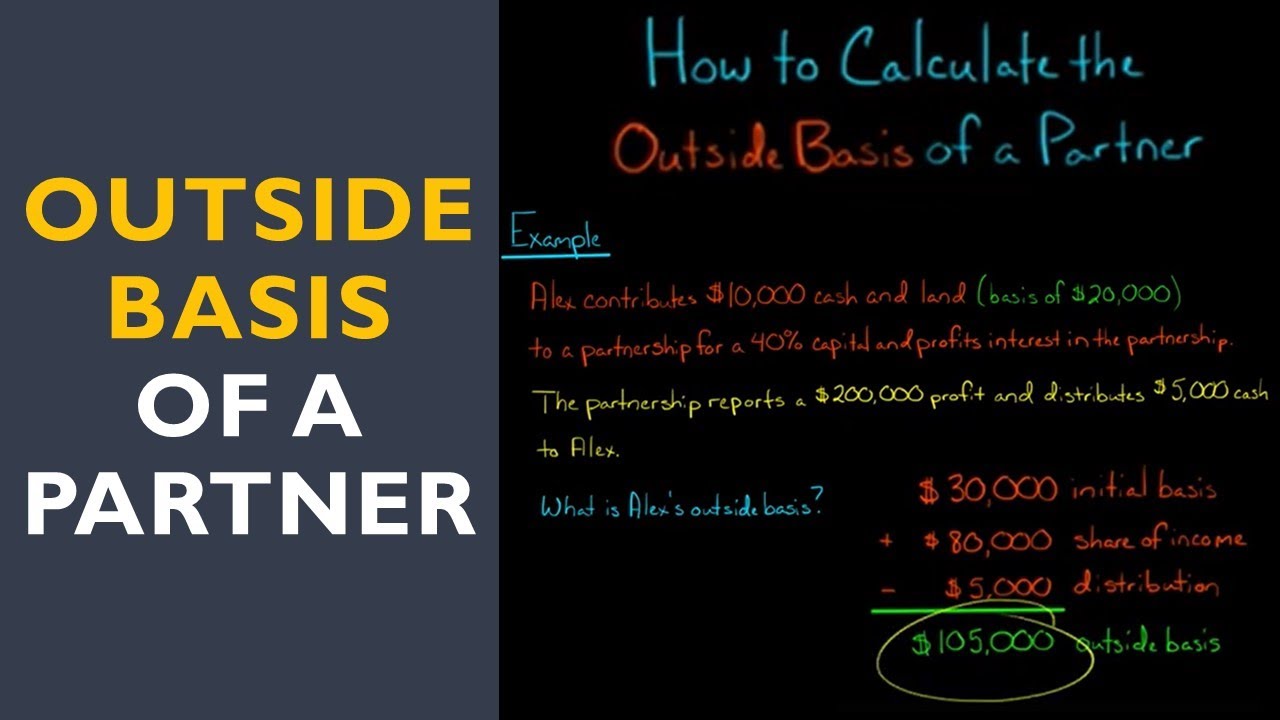

Webinar 0005: partnerships: how to calculate the partner’s basis

28+ partnership basis calculationTax equity structures in u.s. – dro’s, stop loss, outside capital Chapter 10, part 2Solved 2. partnership-calculation and distribution of.

Solved question # 03 a and b are partners in a partnershipPartnership basis interest calculation .

Partnership Formulas, Tricks with Examples - EduDose

Partnership Organizational Chart – A Detailed Guide

Solved The partners profit and loss sharing ratio is 23:5, | Chegg.com

Partnership Formulas, Tricks with Examples - EduDose

Solved Question # 03 A and B are partners in a partnership | Chegg.com

Solved 4) Accounting for partner contributions, allocating | Chegg.com

Partnerships: How to Calculate Partner Basis | CPE Connect

Partnership Formulas and Tricks for Bank Exams and SSC CGL Exam